The Component Cost of Capital Is Best Described as

The carrying cost of inventory is often described as a percentage of the inventory value. The firms marginal tax rate is 34.

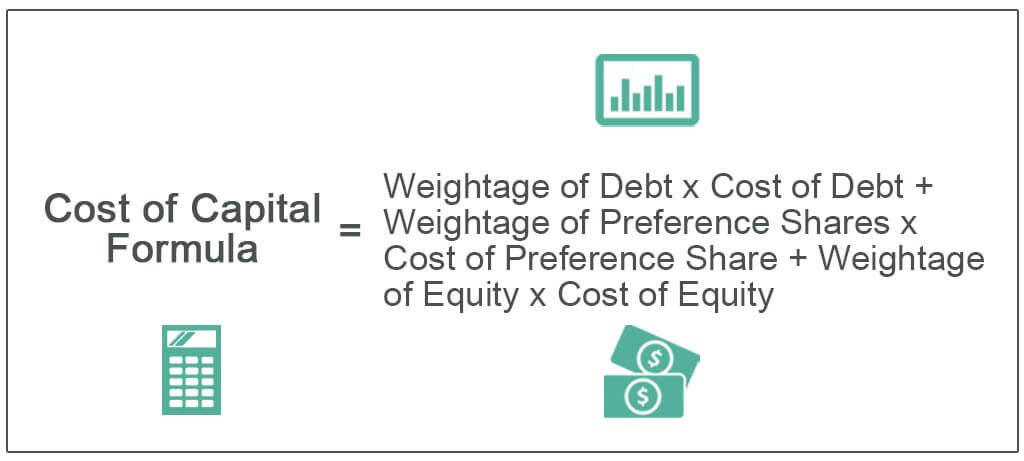

Cost Of Capital Formula Step By Step Calculation Examples

Thus a firms cost of capital may be defined as the rate of return the firm requires from investment in order to increase the value of the firm in the market place.

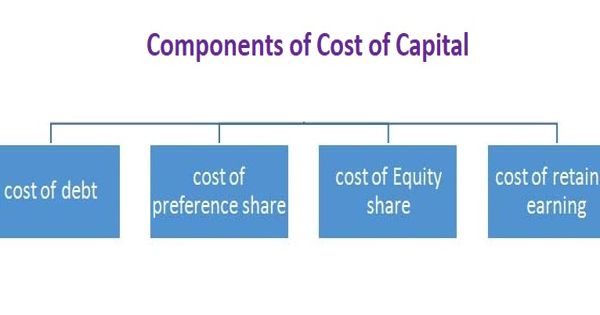

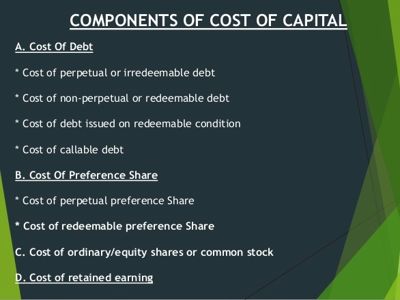

. Components Of Cost Of Capital The individual cost of each source of financing is called component of cost of capital. The component cost of capital is best described as. This percentage can include.

The component cost of capital is best described as. The following are the components of cost of capital. Sheppards own calculation of beta based on daily price data for the last year described in footnote 5 on p.

All else equal a firm with low levels of debt may prefer debt financing because. The component cost of capital is best described as. Both A and B D.

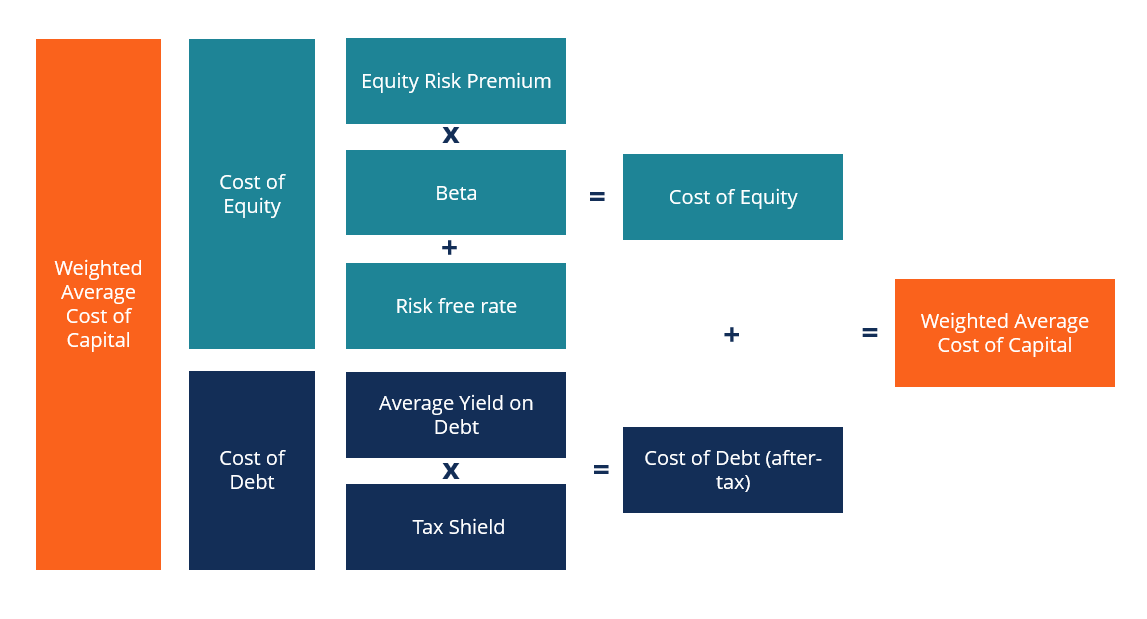

For calculating the cost of capital the capital components are A. 50 points Justify which Treasury yield is the best estimate of the risk-free rate in a cost of capital. R0 Return at zero risk level Premium for business risk Premium for finance risk.

Cost of capital is a companys calculation of the minimum return that would be necessary in order to justify undertaking a capital budgeting. Companies can use this rate of return to decide whether to move forward with a project. A simpler cost of capital definition.

In calculating the cost of capital the following methods can be used. The bonds have a current market value of 1127 and will mature in 10 years. E Market value of the firms equity D Market value of the firms debt V E D R e Cost of equity R d Cost of debt T c.

Determined by interest charged 9-3. Debt may be issued at par at premium or discount. Cost of capital provided by a given creditor or stockholder All else equal a firm with low levels of debt may prefer debt financing because.

Compensation demanded by the investor of a firm after taxes and transaction costs are considered If a firm finances a new project entirely with debt capital but has debt and equity in its optimal capital structure it should. The three components of cost of capital discussed above can be written in an equation as follows. The component of cost of capital is also known as the specific cost of capital which includes the individual cost of debt preference shares ordinary shares and retained earning.

There are four main components to the. Cost of capital issued by a creditor b. Cost of capital demanded by the stockholder c.

1The cost of capital can be described best as. It may be perpetual or redeemable. - cost of internally generated funds - cost of capital demanded by the stockholder - cost of capital provided by a given creditor or stockholder - determined by the amount of interest charged.

Determined by interest charged. In other words it is the expected compound annual rate of return that will be earned on a project or investment. Cost of capital can best be described as the ability to cover both asset and liability expenditures while generating a profit.

Cost of capital provided by a given creditor or stockholder d. A bond that has a 1000 par value face value and a contract or coupon interest rate of 102. WACC E V R e D V R d 1 T c where.

Cost of capital issued by a creditor b. A companys optimal capital budget is best described as the amount of new capital required to undertake all projects with an internal rate of return greater than the. Weighted average cost of capital.

What is Cost of Capital. Debt financing is one of the more frequently sought forms because it is one of the least costly. Cost of capital demanded by the stockholder c.

Rate that a firm pays for the use of invested funds The minimum return required of capital budgeting projects that are about as risky as the firm B. Marginal cost of capital. Cost of capital can best be defined as.

Of tax advantages and the cost advantage debt has over equity. Noncurrent liabilities and ordinary shareholders. That a business must earn before generating value.

The popular estimate based on monthly price data over the previous 5 years described on p. Cost of capital is the minimum rate of return Internal Rate of Return IRR The Internal Rate of Return IRR is the discount rate that makes the net present value NPV of a project zero. The component cost of capital is best described as.

192 paragraph 2 or b. Cost of retained earnings. The three components of cost of capital are.

Cost of Capital Cost of Debt Preferred Stock Retained Earnings Equity Stock Weighted Average Cost of Capital and Return on Capital. The Cost of Debt. Up to 25 cash back Individual or component costs of capital Compute the cost of capital for the firm for the following.

K Cost of Capital. Cost of capital provided by a given creditor or stockholderd. The cost of insuring and replacing items.

How to Calculate of Cost of Capital.

Cost Of Capital Learn How Cost Of Capital Affect Capital Structure

No comments for "The Component Cost of Capital Is Best Described as"

Post a Comment